Top latest Five Three Things To Avoid When You File Bankruptcy Urban news

Someone on our staff will connect you that has a financial Specialist within our network Keeping the proper designation and knowledge.

When you are wanting to know if bankruptcy could make it easier to, Get in touch with us today for a cost-free evaluation. Allow us to find out if our Lawyers will help you protected a brighter economical future.

After which the attorney asks you the dreaded query. The dilemma you hardly ever read about on line and you simply are rather guaranteed George never explained nearly anything concerning this issue.

When you are battling to pay your bills and thinking of filing for bankruptcy, Here are a few things you need to know right before getting that big action.

Bankruptcy might have a devastating effect on your credit rating score. It could possibly stay on your credit score report for nearly 10 years. Here are a few means you can avoid bankruptcy to keep your credit history score intact.

Attempting to discharge the incorrect debts. Another way you'll be able to go wrong in bankruptcy is attempting to discharge non-dischargeable debts. As well as residence home loans, tax debts, liens, college student financial loans, youngster aid and alimony, non-dischargeable debts also include debts arising from liability for driving whilst intoxicated and debts acquired inside six months of filing for bankruptcy.

Sometimes, when men and women question on their own these queries, they get a lot more nervous about what's going to take place to them and their property when they file bankruptcy. So, they start link looking on line and what do they see? why not check here They see that find men and women do, certainly, reduce property once they file bankruptcy!

Investing less revenue could assist you to dedicate more of it to having to pay down your credit card debt. You might be able to liberate dollars in your price range by chopping cable, canceling your gymnasium membership, or skipping takeout for meal. This could assist you pay off your debts eventually to avoid filing bankruptcy.

Upcoming, you are looking at filing bankruptcy, however , you can’t stand the thought of adding uncle Fred to the bankruptcy. After all, He's family appropriate? Uncle Fred lent you 50k to start the dry cleansing enterprise and it’s not his fault the business enterprise didn’t thrive.

Our workforce of reviewers are established industry experts with a long time of practical experience in spots of non-public finance and hold many Superior degrees and certifications.

In the Chapter 13 Bankruptcy, you don’t lose your assets so long as you pay back your creditors what Go Here they would have acquired had you filed a Chapter 7 Bankruptcy.

it designed the method straightforward with no law firm and providing a lot of resources so you're knowledgable about bankruptcy and also the filings system.

We also reference first study from other reliable publishers exactly where ideal. You are able to find out more regarding the criteria we abide by in producing precise, unbiased material inside our

You will not essentially be able to shake off all of your debts in bankruptcy. For example, Congress has determined that specified types her response of debt—like youngster guidance and taxes—can't be discharged in bankruptcy for public coverage good reasons.

Brian Bonsall Then & Now!

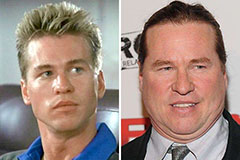

Brian Bonsall Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!